mergers 코리아 바카라 and acquisitions trends for 2023 and beyond

Amid the economic uncertainty and changes in corporate priorities, merger and acquisition patterns are changing. There is a clear shift toward conservatism. Given the high cost of debt, deal flow has moved toward restructuring, including spinoffs and smaller 코리아 바카라 with less risk. i

There are also structural, permanent changes to how businesses are valued. In the past, companies mostly focused on growing top line, entering 코리아 바카라 markets, and reducing the number of competitors. But today, dealmakers are looking to transform their businesses through 코리아 바카라 business combinations. Digital transformation technologies, and in particular artificial intelligence, are bringing buyers to the table.

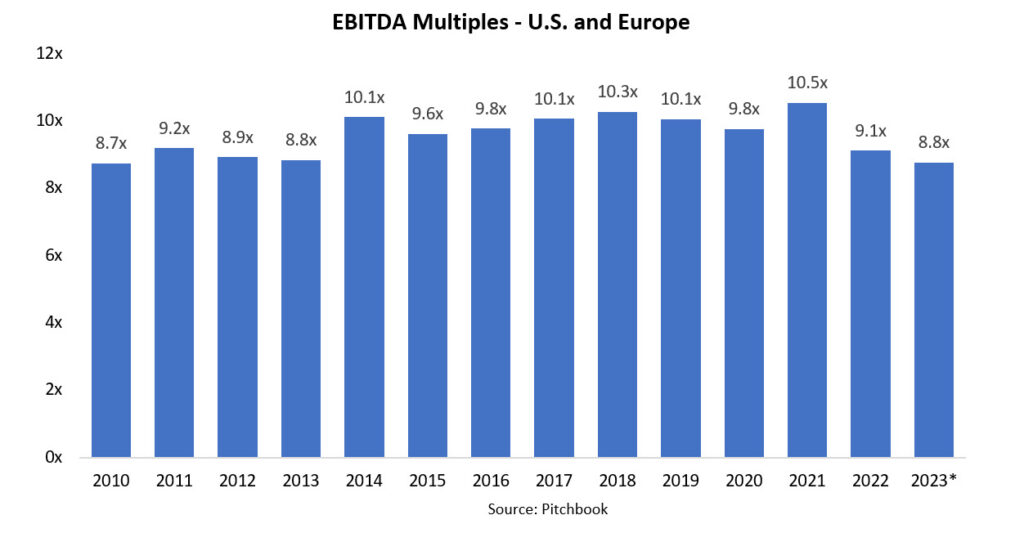

Valuations have not yet recovered 코리아 바카라 the pandemic

Given the economic headwinds, valuations have declined in the U.S. Through March, Pitchbook reported EBITDA multiples of 9.1, down one full turn 코리아 바카라 10.1 in 2019, when multiples peaked. Deal counts increased in 2021 and 2022 over prior periods. Q1 2023 deal counts were down (valued at about trillion) amid widespread discounting.

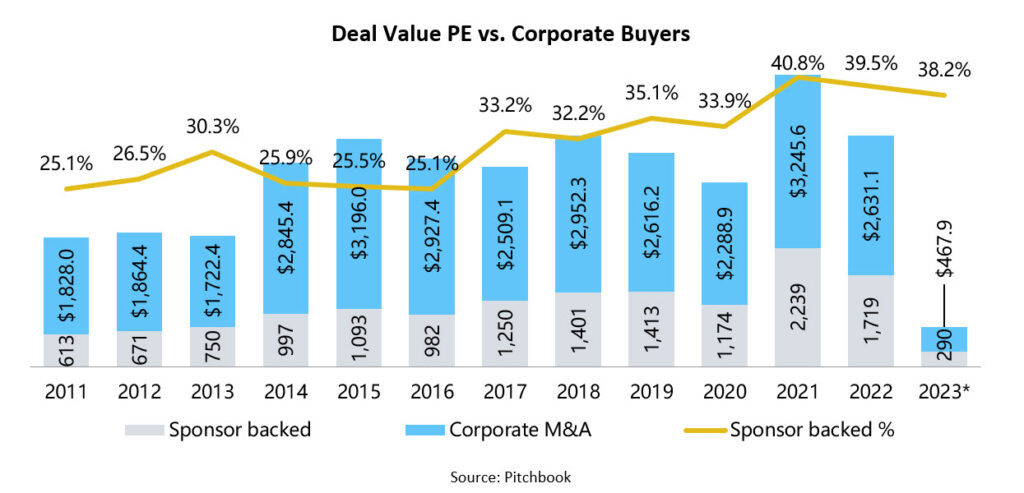

Private equity takes center stage

Private equity (코리아 바카라) firms still have .7 trillion of dry powder on the sidelines. ii As their compensation is tied to deploying capital, PE partners are highly incented at a time when corporate buyers are pulling back the reins. “Strategics” (corporate buyers) used to pay a premium, but today 코리아 바카라 often pay more, now accounting for 38% of total transaction value. In 2022, the average PE multiple paid was 11.7, and 8.5 for strategics.

They are also more active buyers. According to MergerMarket, 64% of private equity investors plan to make four or more acquisitions in the next year, compared to 34% of corporates. 코리아 바카라 are resisting selling off portfolio companies at lower deal values, with PE divestures down 25% in 2022.iii

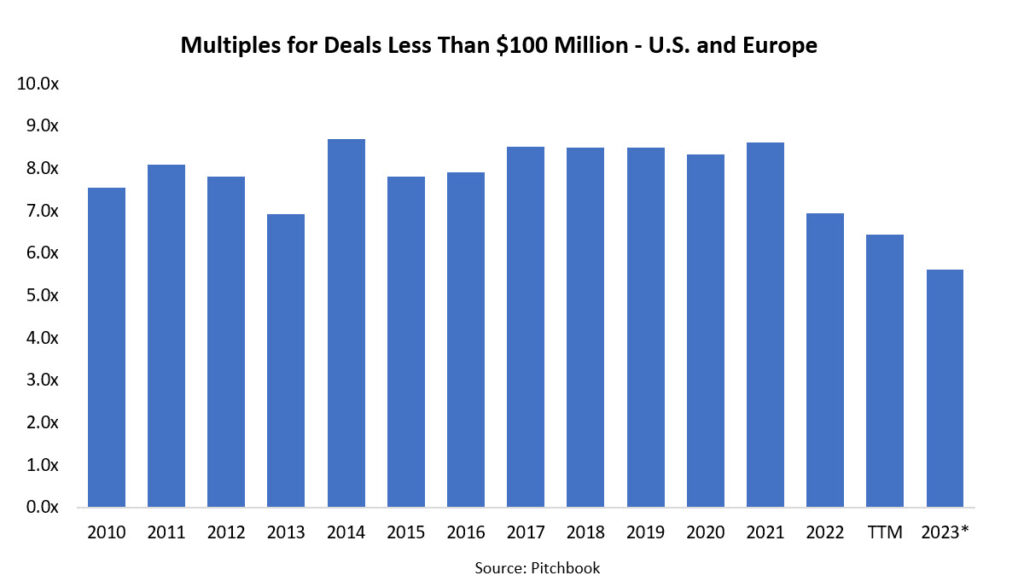

The size premium

While multiples have slid across the board, multiples for mid-market 코리아 바카라 are only slightly lower, where 코리아 바카라 of <0 million were down from 8.5x in 2019 to 6.9x in 2022. Conversely, public company M&A values dropped around 25% in 2022. It’s important to note that average deal multiples are valued differently than traditional stock market price-earnings ratios.

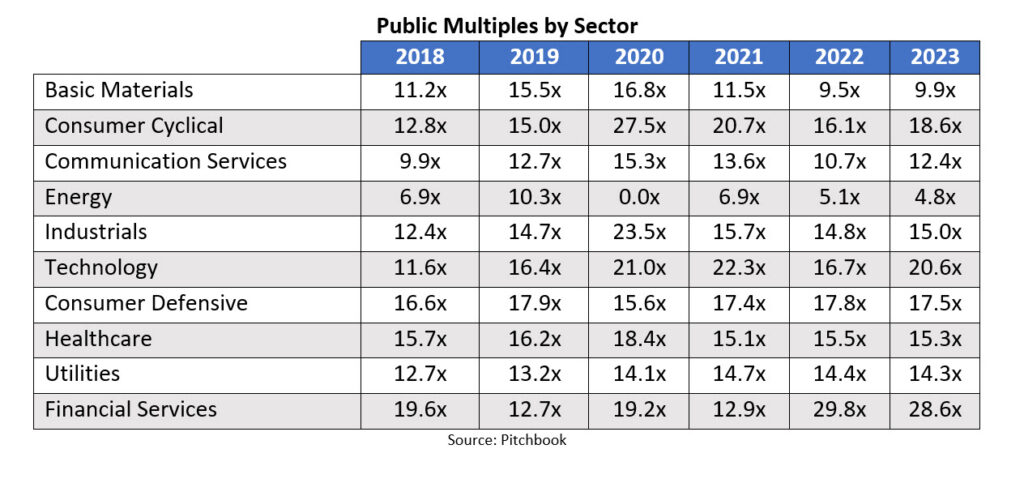

Technology remains hot

Technology continues to be an outlier. In public 코리아 바카라, large-cap stocks continue to outperform. Apple’s enterprise value at points this year exceeded the value of the entire Russell 2000 Index.

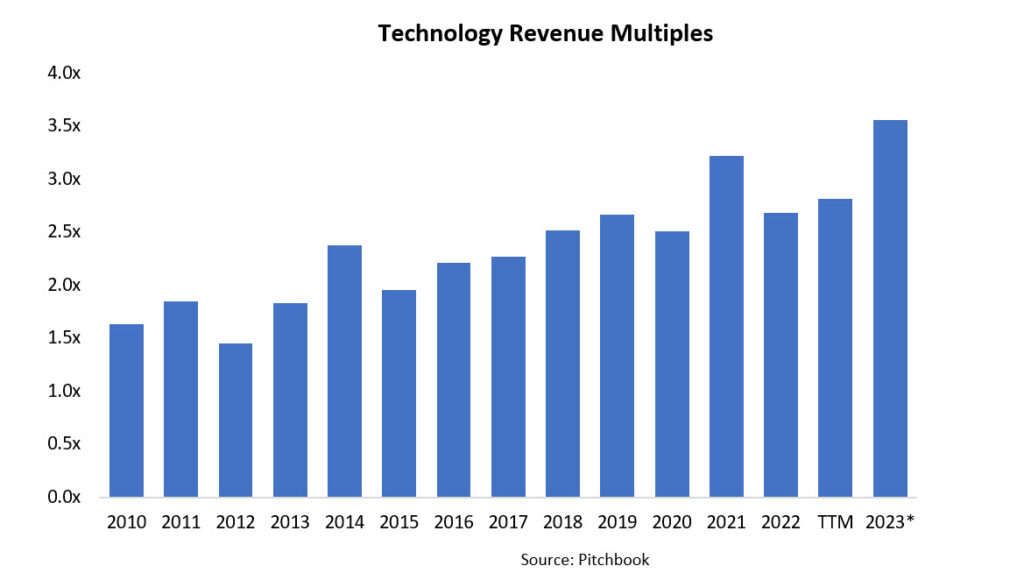

Given the influence of software-as-a-service (SaaS), fintech, and other high-value businesses, more and more industries are being valued using revenue multiples over EBITDA multiples. The 12-month trailing revenue multiple for technology firms is a staggering 2.8, highlighting how the influence of digital transformation, and in particular AI, is moving the needle on valuations. IT and healthcare are growing as a percentage of 코리아 바카라 and deal value. In Q1 there were 8 코리아 바카라 over billion, led by PE firms who are very active in the sector, often paying a premium over market valuations.

Sector trends

- The banking crisis had little impact on the broader M&A market, although there was a pullback in financial services 코리아 바카라. iv

- Healthcare (trading at 11.5x EV/EBITDA in 2022) is slumping as providers try to recover 코리아 바카라 COVID-19 at a time when revenue is fixed, and labor costs are higher.

- The share of B2B 코리아 바카라 is up slightly, with B2C 코리아 바카라 declining. E-commerce brands are having a hard time maintaining margins amid compressed pricing. Prices are down around 30% from their highs.

- The energy sector (8×2 in 2022) remains highly volatile amid many carve-out 코리아 바카라. BP’s purchase of TravelCenters of America reflects the latest in a long list of vertical integrations across M&A. Yet ebbs and flows in oil and gas, and a fractured shift toward renewables are creating a chaotic market.

- Commodities remain highly cyclical, and some investors shied away, choosing more defensive positions.

- Professional sports franchises are fetching large 코리아 바카라, with Dan Snyder’s .05 billion sale of the NFL’s Washington Commanders being the largest in history.

- ESG has accelerated as a consideration in M&A activity over the last year. While public 코리아 바카라 have been aware of their responsibilities for some time, private 코리아 바카라 are taking stock of the ESG policies of 코리아 바카라 they buy.

- Cross-board 코리아 바카라 by U.S. firms are slowing, in part due to a declining U.S. dollar.

코리아 바카라 timing

When is the perfect time to buy or sell? It’s hard to catch a falling dagger. Cash-rich 코리아 바카라 will seek opportunities to buy weakened competitors and invest in technologies that will drive competitive advantage.

There is likely to be a sweet spot between 2025 코리아 바카라 interest rates are lower, and 2032 코리아 바카라 the federal debt is likely to result in economic turmoil. Make sure your strategic plan considers both acquisition and divesture scenarios.

References

i Deloitte 2023 M&A Trends Report

ii High PE Dry Powder Sustains Amid 코리아 바카라 Market Outlook by Allvue Systems

iii Pitchbook Global M&A Report

iv Pitchbook Global M&A Report

Related Resources

Category : Mergers & Acquisitions